Behavioral Science and the Art of Spending Less

There are four popular ways of growing your wealth:

- Spending less

- Investing wisely

- Earning more

- Getting lucky

They all differ in their effectiveness and difficulty of implementation.

- Spending less: the easiest of all

- Investing wisely: difficult; requires expertise

- Earning more: not easy, but the most effective

- Getting lucky: ¯\_(ツ)_/¯

“Spending less” is the low hanging fruit out of the four. It’s directly tied to human behavior, and we can apply techniques backed by research to help us spend less.

The Science

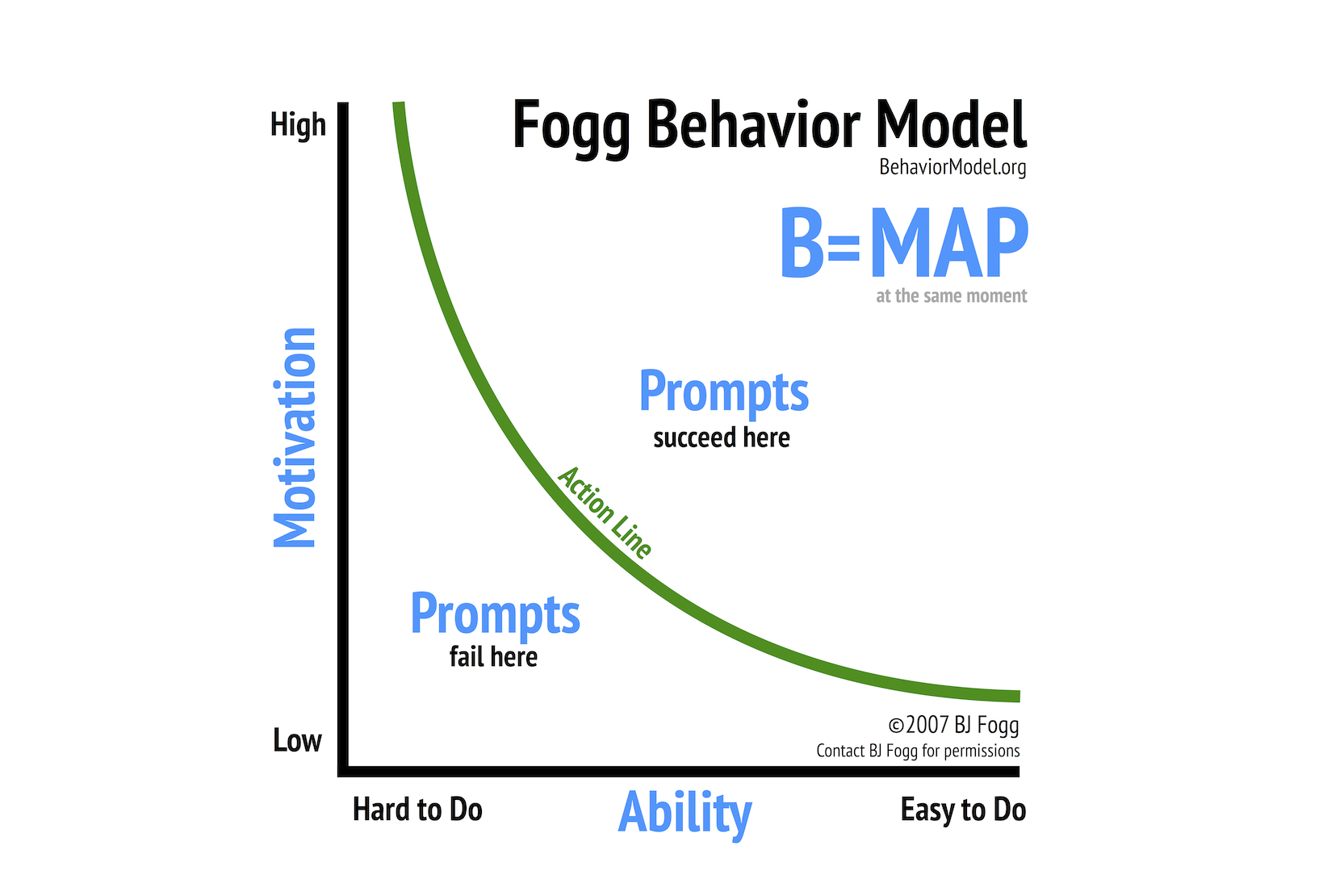

The Fogg Behavior Model states that behavior occurs at the intersection of 3 things:

- Prompt for an action

- Motivation to do the action

- Ability to perform the action

Image used with appropriate permission from BJ Fogg

Some examples:

- Upon encountering a bug 🐞 in the Linux OS (prompt), I may have a strong desire (motivation) to submit a patch to the Linux kernel, but it’s well beyond my ability to do so. I will not do it. 😅

- After brushing my teeth in the morning (prompt), I can easily do 20 pushups (ability). But. I. Just. Want. My. Coffee. ☕ (motivation)

- I see a bowl of cashews and dates on the dinner table (prompt). I love dates (motivation). I will pick them up and eat (ability)

To summarise:

When we’re prompted to act, if we have the ability to do it and high enough a motivation to do it, we do it. If either is lacking, we don’t.

Spending falls in this same model.

- You’re on Twitter, someone tweets a picture of something enticing you’ve been thinking buying, you go to Amazon and buy it with a few clicks. ✅

- A friend tells you about an excellent book they’re reading; you go to Goodreads, find the reviews and descriptions. You’re convinced. You buy. ✅

- You hear about a great electric bike that looks fabulous and seems like a perfect fit for you. You notice the price is way out of your budget. You don’t buy it. 🚫

So how do we use what we learned above? Often the easiest way is to remove the prompts. It works like a charm. But it’s not always possible. The prompts will occur, and we will have to rely on reduced motivation and reduced ability to prevent the action.

A strategy for minimizing spending

- Figure out a reasonable expenditure cap for your household, say ₹ X0,000/month 💸

- This includes all outgoing: rents, EMIs, groceries, eat-outs, credit card payments, shopping, what have you. 🏠 🛍️ 🥘 (Review this figure twice a year)

- Dedicate an account for these expenses. Each month, put this amount there. Direct ALL YOUR SPENDING to this account. All. 🔑

- When you run out of money in this account, DO NOT SPEND. 🙅🏼♂️ 🚫

- If you use credit cards, you can only spend what you have in THIS ACCOUNT. No more. No converting into EMIs. 💳

- Do not deviate far from your personality. e.g., I love occasional shopping and splurging, and so I account for it. Moderation is key. Without it, you will fall off the wagon quickly. ✋🏼 🛑

- If you can, rely on spouses, partners, parents, children for accountability. Return the favor and be accountable for them. 👪

- Account for annual, non-monthly, and aperiodic expenses. Insurance policies, vacations, school fees, furniture, laptops, what have you. 🎒 🏖 🏔️ 💻

- Distribute the amount monthly. Put it in liquid funds (consult experts for this) connected to the same spending account. 💰

- Direct ALL THOSE EXPENSES to this account. All. 🔑

- Seeding/overdraft: Sometimes significant expenses come before you’ve accrued enough in the expense account. Have an overdraft margin for it and treat it as a loan to yourself.

- A reasonable limit allows you to spend just enough to have a happy lifestyle and yet limits spending. ⚖️

Parting thoughts

We accepted that spending prompts will occur. By decreasing our ability to spend we’ve pushed the prompt from action zone to no action zone.

Relying on motivation alone is a strategy fraught with peril. By gaming ability and prompts, you can prevent bad behavior or encourage good behavior. Spending less is just one tiny application of this powerful technique.